Fourth Quarter 2017 Securities Markets Commentary

Index Performance and Analysis

Few expected it, but 2017 was an excellent year for securities markets. Diversified domestic large cap stocks, represented by the S&P 500 index, saw a 22% gain for the year. The relative concentration of industrial and technology stocks led to outperformance for the Dow Jones Industrial Average and the Nasdaq Composite; both advanced an impressive 28%. Small company stocks lagged their larger peers last year with the Russell 2000 index returning 13%. Bond performance in the aggregate was tepid. Interest rates made gradual moves higher in the final quarter of the year and the comprehensive Bloomberg Barclays index appreciated 3.5%.

The Calm Bull Market

Records were broken, streaks were extended, and milestones were surpassed. Prices moved little on a daily basis, but the little they did move tended to be toward the upside. Investors acted as realists, as impartial observers, in not allowing uncertainties or what-ifs to dictate their collective buying and selling. Instead investors assessed the health of the global economy, judged it to be robust, and decided, with reasoned calculation and little fanfare, to take part in that growth. Such behavior is the exception that proves the rule—that investors on the whole are prone to irrational short-term decision-making—so we can expect a reversion in the years ahead. But we shouldn’t let that detract from that year that was 2017: despite the uncertainty and instability of the current global political moment, markets and economies were able to advance in tandem.

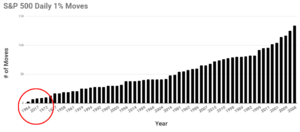

The story that dominated discussion of the markets in 2017 was the complete absence of volatility. Stock prices rose at a deliberate pace. There were no exuberant bursts of buying and, likewise, there were no panicky pangs of selling. Down days—we hesitate to call such minor daily movements “dips”—were always followed by more than enough buying to make up for whatever had been sold off the previous days. Daily price changes for the S&P 500 stock index moved 1% or more (either up or down) only eight times last year. To help put this in perspective, the average number of 1% moves for the index per year is 52. This is the fewest number of such moves since 1964, and the third fewest in the history of the index. The table below illustrates this unusual lack of movement.

The S&P hasn’t dropped over 2% in a day since September of 2016.

This low volatility was accompanied by the sustained march higher of stock markets both here and abroad. In addition to being exceedingly quiet, the S&P 500 set records during its unassuming ascent: the index closed at all-time highs a total of 62 times, the second-most on record. With dividends the S&P was positive every month of the year, the first time in its history. The Dow also enjoyed a historic year in terms of heights reached amidst a lack of volatility. The index, composed of just 30 large stocks, crossed five 1,000 point milestones last year to finish above 24,000 for the first time ever. As of this writing it has already surpassed 25k and is very near to 26k. And these gains were accomplished with the Dow at its most calm since 1964.

Growth stocks reasserted their dominance this past year after temporarily deferring to their cheaper value cousins in 2016. The Nasdaq, composed mainly of growth stocks, closed at all-time highs a total of 72 times. Investors poured money into technology stocks and never relented. The technology sector was far and away the top-performer for the year. The sector rose nearly 40%. Other sectors performing well last year were consumer discretionary stocks (boosted by Amazon and Netflix), health care, and the “Trump Trade” sectors: financials (counting on deregulation and rising rates), industrials and materials (both infrastructure plays).

Global Markets Outperform

Along with “low volatility,” the other buzz word term among financial journalists used to describe 2017’s markets was “synchronized.” Economies and markets the world over all grew, almost without exception. For the first time since 2007 every member country of the Organization for Economic Cooperation and Development (the OECD) recorded growing economies last year. These expanding economies instilled confidence in investors and led the majority of international stock markets to outperform our own. The last time this happened was back in 2012. The chart below tells the story: the S&P 500 is represented by the dark green line on the bottom and the other lines represent Europe, Asia, Latin America, and emerging markets.

As you can see, from the emerging markets of Brazil and India to the developed markets of Japan and the U.K., all enjoyed stock returns of over 20%.

International markets have performed an impressive about-face from where they were just a year and a half ago. Mid-2016 saw investors grappling with the implications of Brexit, the fallout from China’s currency manipulation, negative interest rates, and the threat of deflation. No more. The IMF has revised global growth upward; global consumer confidence is reading levels not seen in 20 years; global manufacturing is growing steadily; and global earnings growth is at its fastest pace in seven years. 2017’s broad global recovery from its prior stagnation—thought by many to be a permanent condition—is now unmistakable.

Key Economic Indicators

Gross Domestic Product

GDP expanded in the middle half of last year at a reasonable, improving pace. Business owners and consumers, invigorated and confident, are beginning to invest and spend the economy out of its decade-old 2% growth malaise. Growth for the third quarter came in at a respectable 3.2%. This is the first time since 2014 that we have had two consecutive quarters of greater than 3% growth. Both the supply and demand sides of the economy are showing improving numbers. American manufacturing is thriving. Manufacturers have benefited from the rare aforementioned synchronous global growth and stand to reap additional benefits in 2018 from the Republican tax cut package. Consumers remain confident thanks in part to the solid jobs market and we have finally begun to see this confidence translate into renewed spending.

We stress again that consumer spending accounts for two-thirds of GDP so November and December’s strong holiday spending has the potential to lift fourth quarter growth above the all-important 3% threshold. As of this writing, the Federal Reserve Bank of Atlanta’s most recent forecast for fourth quarter growth stands at 3.3% and the New York Fed is predicting 3.9% growth. Such a GDP showing would be crucial evidence of a rejuvenated economy. We note well that the United States economy has not grown over 3% for three straight quarters since 2004.

Consumer Confidence

Last year consumer confidence and sentiment reached levels not seen in twenty years. American consumers have displayed an impressive ability to compartmentalize the deluge of news with which they are bombarded every day. Our principal media organizations, both right and left leaning, are peddling in sensationalism, allowing themselves to be egged on by our president to their own detriment. And so we have the constant gloomy refrains of civil unrest, amateurish international relations, and entire news cycles devoted to single sentence tweets, etc. Despite all this consumers maintained record-level sentiment and confidence in our economic situation.

American consumers are able to separate the spectacle of political back and forth from the real-life effects of the economy. We are at full employment and, as a result, wages have begun a modest march upward. What’s more, the tax reform will likely result in further wage gains this year as employer corporations and small businesses pass on savings to retain their best employees. Consumers are feeling the effects of the healthy growing economy in their day-to-day lives and these positive interactions have been reflected in elevated confidence and sentiment.

Labor Market

The labor market remains robust and was further strengthened through the end of last year. The unemployment rate in December fell to 4.1%, almost a full percent below the “normal” rate and a number last seen during the dot-com boom in 2000. Prime-age (25-54) participation is increasing and we have gone 87 straight months with additions to the labor market. We last had a monthly net job loss in October of 2010. Wage growth remains subdued, frustrating workers and surprising economists expecting better growth as employers compete to hire from a shallower pool of applicants. Further job growth and tax cut savings could lead to more substantial wage gains, which gains have long been the missing ingredient in our strong labor market.

Looking Ahead to 2018

It is a fool’s errand to make predictions as to how markets will perform at some later point in the future. But that doesn’t stop the money management chattering classes from offering their two cents—or two billion, as the case may be. Most market predictions are of the variety that specializes in saying nothing. These forecasts hedge to such an extent that the reader is left no better informed about the markets than before they started reading. “The market could go up, but, on the other hand, the market could go down.” Not helpful, to say the least. Because nobody can predict the future, especially when human behavior is involved, all of these stock market prognostications should be taken with a heaping helping of salt.

That being said, we will not attempt to conjecture where markets will end up this year. Rather, we will examine trends: what we know, what we don’t know, and what these trends mean to your investment portfolios. With our investment management software capable of both recognizing these trends and controlling for portfolio volatility amid today’s complex securities markets, we believe we are prepared for whatever type of market unfolds this year and wherever it might end up.

Trends to Watch

We know that economies the world over are expected to continue to expand in 2018. Global growth fell to a post-2008 crisis low in 2016 and has been recovering ever since. Emerging markets nations have righted themselves as domestic consumption and worldwide demand for commodities (including oil and metals) has been revived. Developing stalwarts China and India are expected to grow 6.9% and 6.5% respectively. The Eurozone and other developed nations are also on track to expand in the medium-term. Boosted consumer sentiment will lead to even greater spending which in turn will lead to improved company earnings growth.

Last year the price per barrel of oil rose to levels not seen since they crashed from their peak of over $100 back in 2014. On the supply side, OPEC and its fellow travelers have held firm in their production cuts and domestic frackers have tapped the brakes on their breakneck drilling. On the demand side, synchronized global growth has nations large and small consuming an increased amount of energy to help fuel their expansions. We expect this trend to persist in 2018 as oil finds its own level.

An underappreciated trend this past year and one of the latent drivers of the market’s gains was the deregulatory agenda of President Trump. All told, federal government agencies issued 67 deregulatory actions compared with just three regulatory actions. Over 1,500 Obama administration rules have been withdrawn or delayed, and the Federal Register (the official compilation of rules and notices) is at its lowest page count since 1993. From the FCC rolling back net neutrality (a 2015 invention) to the EPA scaling back emissions output requirements and narrowing the definition of waterways, the agencies of the federal government are loosening their grips on businesses and individuals. This notable trend is underappreciated because the costs and benefits of deregulation aren’t immediately quantifiable but are better appreciated in retrospect or by considering long-term effects. One free market think tank estimated the total cost of federal regulation to businesses and individuals in 2016 to be $1.9 trillion.

Businesses incur substantial costs in order to comply with often-times arbitrary rules and are at the mercy of bureaucrats who may exercise, in the memorable words of the late Justice Scalia, “the discretion of an enlightened despot.” These costs are then passed on to consumers. Without these rules with which to comply businesses can rather invest in themselves and their employees. And these cost savings are likewise passed on to consumers through lower prices. While big multinational energy, technology, and financial corporations obviously stand to benefit from deregulation, perhaps more important are the burdens lifted from small-to-medium size businesses whose compliance costs eat a larger share of their annual budgets. Indeed small business optimism surged last year approaching levels last seen at the early stages of the 1980s bull market. Deregulation will never be headline news but with more on tap for 2018 we expect that this pivotal trend will underpin future economic growth.

The prospect and eventual passage of the Republican tax reform package added support to the economic fundamentals foundation of 2017’s stock market rise. The reform’s most significant feature, the slashing of the corporate tax rate from 35% down to 21%, will lead to higher growth in the years ahead. Indeed the tax cuts may even kick-start long dormant productivity through expensing incentives built in to the reform that strongly promote business investment in the latest technology and equipment for their employees. Corporate announcements of bonuses, profit-sharing, and minimum wage hikes have been released almost every day since the bill’s passage. Americans for Tax Reform, a nonprofit opposed to tax increases, maintains a running list of these announcements. So far over 180 companies—ranging from American Airlines to Walmart—have announced their intentions. These corporate tax cuts are permanent, so businesses putting their savings to work through investments in human capital and capital equipment are very likely to have long-lasting positive effects on the economy.

Risks to Appreciate

We know that there are plenty of unknowns, or risks, threatening markets in 2018. The nuclear standoff with North Korea remains a precarious, if somewhat contained, situation. The rogue state’s principal patron, China, is led by Xi Jingping, a Mao Zedong for the 21st century. Xi has not been shy about broadening the communist state’s influence or about reasserting government control of all of the capital within its borders. When the People’s Bank of China devalued the yuan in 2015-2016 we saw the market turbulence reverberate around the world. So any significant economic or militaristic move by China, then, has the ability to disturb markets in the new year.

With the price of oil unlikely ever to return to its peak, the stability of the oil-dependent Middle East is a critical unknown in the year ahead. Saudi Arabia, under the new leadership of reformist Mohammed bin Salman (styled MBS), has taken multiple steps to expand its sphere of influence in the region. In addition to fighting a proxy war with Iran in Yemen, MBS has opened talks with Israel to pursue their mutual interest in containing the arrogant Islamic Republic. And with the Ayatollahs now dealing with internal dissension thanks to their faltering theocratic mismanagement of the economy, we will be paying close attention to any further developments and their potential to affect markets in 2018.

The leading economic risk to markets this year is the prospect of an overheated economy. The thinking is that accelerated global growth will lead to similarly accelerated inflation. And this inflation will be hard to constrain because central banks have kept interest rates so low for so long. These fears seem premature. The most recent inflation readings have shown only mild gains and core inflation is still running below what is considered to be the natural rate (around 2%). Nevertheless, with the injection of so much capital back into the domestic economy from the tax cuts, along with historically low unemployment and personal savings rates, inflation will be a development to consider through this year.

Controlling Our Investment Process

The fear underlying these various unknowns is that each could trigger a bout of selling that could snowball into a correction or worse. Some maintain that the current bull market is particularly fragile by the mere fact of its age and its low volatility. These observers see parallels to the internet-fueled late stages of the 1990s bull market: an almost unthinking run up in technology stocks accompanied by soaring asset prices. Others see important differences: the recent rotation to technology stocks has been concentrated in older, established companies instead of speculative initial public offerings, and buying has been measured instead of euphoric. Past performance, of course, is no indication of future results although we can be sure that the market will not advance forever.

Moreover, it is impossible to gauge the market’s reaction to the various possibilities for disruption through the coming year. Will investors shrug off sensationalist news as they did in 2017, or will they finally be spooked and start to sell? To paraphrase the economist Michael Mauboussin, we cannot control these outcomes but we can control our investment process.

Our investment process is guided by our proprietary investment management software. With this software we can make unemotional allocation decisions through the analysis of near-term price trends. The software thus enables us to participate in meaningful market appreciation and gives us the ability to rotate to defensive positions should disruptions and volatility become reality.

Performance Disclaimer

No investment strategy or methodology can guarantee profits or protect against losses. Investment risk includes the uncertainty and volatility of potential returns for a portfolio or an individual investment over time. Investment risk is inherent in every individual portfolio and no computer model or modeling program used or relied upon in making investment choices for a portfolio can eliminate risk. A computer modeling program may not reflect actual risk and return parameters applicable to any particular portfolio or investor. Actual investment decisions made on the basis of a computer generated model or modeling program may be materially different from expected or intended results, and any computer modeling program is subject to errors in the program and system failures at any time.

Sources:

- http://www.bea.gov (GDP data)

- http://www.bls.gov (employment data)

- http://www.finance.yahoo.com (index returns)

- http://www.sca.isr.umich.edu (consumer sentiment)

- Atlanta Fed GDPNow: Forecast for 2017: Q4, Federal Reserve Bank of Atlanta, January 12, 2018.

- The Great Rules Rollback, Wall St. J., 26, 2017, at A14.

- International Monetary Fund. 2017. Seeking Sustainable Growth: Short-Term Recover, Long-Term Challenges. Washington, D.C., October.

- Minutes of the Federal Open Market Committee, Board of Governors of the Federal Reserve System, December 12-13, 2017.

- New York Fed Staff Nowcast: Federal Reserve Bank of New York, January 12, 2018.

- Press Release, Blackstone Group, Byron Wien Announces Ten Surprises for 2018 (Jan. 2, 2018)(on file with author).

- The Tax Reform Promise, Wall St. J., 20, 2017, at A20.

- Gunjan Banerji, VIX Records Calmest Month Ever, Wall St. J., 1, 2017, https://goo.gl/N2YA3g.

- Gunjan Banerji and Daniel Kruger, Treasury Yields Are on a Roll—Higher, Wall St. J., 21, 2017, at B11.

- Robert J. Barro, Tax Reform Will Pay Growth Dividends, Wall St. J., 5, 2018, at A15.

- Mike Bird, Record Earnings Mark Global Recovery, Wall St. J., 6, 2017, at B16.

- Sarah Chaney, Consumer Confidence Surged in October, Wall St. J., 31, 2017, https://goo.gl/zWyP8x.

- Clyde Wayne Crews, Jr., So, What Regulations Did Trump Eliminate?, Competitive Enter. Inst., Dec. 27, 2017, https://goo.gl/cTS9se.

- Clyde Wayne Crews, Jr., Ten Thousand Commandments: An Annual Snapshot of the Federal Regulatory State, Competitive Enter. Inst., May 2017 (on file with author).

- Clyde Wayne Crews, Jr., Trump Regulations: Federal Register Page Count Is Lowest In Quarter Century, Competitive Enter. Inst., 29, 2017, https://goo.gl/gjNkdU.

- Gavyn Davies, Can secular stagnation morph into secular expansion?, Financial Times, Jan. 7, 2018, https://goo.gl/5VUHEo.

- Chris Dieterich, Industrial Stocks Pump Up Index, Wall St. J., 5, 2018, at A9.

- Corrie Driebusch, Record Run Defies Skeptics, Wall St. J., 30-31, 2017, at A1.

- Corrie Driebusch and Michael Wursthorn, Dow Races Through 23000, Wall St. J., 19, 2017, at A1.

- William C. Dunkelberg and Holly Wade, NFIB Small Business Economic Trends, NFIB Research Center, Dec. 2017 (on file with author).

- Ben Eisen, October Was a Month of Records in the Stock Market, Wall St. J., 31, 2017, https://goo.gl/EwU5J2.

- Ben Eisen, S&P’s Record Streak Produces Smallest Gains in Half a Century, Wall St. J., 6, 2017, https://goo.gl/A4qgRW.

- Jamie Farmer, Dow Jones Industrial Average: Report Card – 2017 Year in Review, S&P Dow Jones Indices, Dec. 2017 (on file with author).

- Farnaz Fassihi and Asa Fitch, The Spark Behind Iran’s Unrest: Defrauded Investors, Wall St. J., 12, 2018, at A1.

- Martin Feldstein, Stocks Are Headed for a Fall, Wall St. J., 17, 2018, at A17.

- Theo Francis, Firms Plan to Share Wealth, Wall St. J., 21, 2017, at A5.

- Riva Gold and Corrie Driebusch, S. Stock Rally Was No Match for Global Peers in ’17, Wall St. J., Dec. 30-31, 2017, at B12.

- Miao Han, Jeff Kearns, Xioqing Pi, and Kevin Hamlin, Xi Jingping’s Debt Clampdown Has Left a Trail of Dead Projects, Bloomberg News, 15, 2018, https://goo.gl/t2Ug6S.

- Greg Ip, Bill Fixes Some Problems, Exacerbates Others, Wall St. J., 21, 2017, at A4.

- Paul Hannon, Eurozone Businesses, Consumers Undeterred by Political Uncertainty, Wall St. J., 30, 2017, https://goo.gl/Ewyjo2.

- Paul Hannon, Growth In Global Economy Is Robust, Wall St. J., 24, 2017, at A7.

- Rory Jones, Mirroring Saudis, Israel Seeks to Counter Iran and Hezbollah, Wall St. J., 8, 2017, https://goo.gl/Tz8zJF.

- Suzanne Kapner, Retail Sales Go Ka-Ching, Wall St. J., 26, 2017, at A1.

- Justin Lahart, No Stock Bubble but Rising Risks, Wall St. J., 20, 2017, at B11.

- Ben Leubsdorf and Nick Timiraos, Prices Data Bolster Inflation View, Wall St. J., 13-14, 2018, at A2.

- James Mackintosh, In Growth Vs. Value, A Shift Takes Hold, Wall St. J., 28, 2017, at B1.

- Sarah McFarlane and Summer Said, Saudis Go Shopping In U.S. Shale Patch, Wall St. J., 21, 2017, at A1.

- Nicholas Megaw, Eurozone economic confidence hits highest level since 2000, Financial Times, Jan. 8, 2018, https://goo.gl/yoRdby.

- Josh Mitchell, S. Economy Picks Up Steam, Wall St. J., Oct. 28-29, 2017, at A1.

- Joshua Mitchell and Nick Timiraos, Economy, Markets Rev Up, Wall St. J., 1, 2017, at A1.

- Imani Moise, Retailers Get Bump From Holiday Sales, Wall St. J., 9, 2018, at B6.

- Eric Morath, Jobs Notch Another Robust Year, Wall St. J., 6-7, 2018, at A1.

- Sharon Nunn, Holiday Spending Tops Forecast, Wall St. J., 15, 2017, at A2.

- Akane Otani, Dow Surpasses S&P, Nasdaq As Stocks Surge in October, Wall St. J., 1, 2017, at A1.

- Steven Russolillo, Stock Markets Around the World Hail 2017, Wall St. J., 28, 2017, at B13.

- Gerald F. Seib, Trump’s Deregulatory Juggernaut Is Rolling, Wall St. J., 31, 2017, at A2.

- Alison Sider, A Year After OPEC Deal, Oil Prices Firm, Wall St. J., 26, 2017, at B10.

- Alison Sider, Global Growth Boosts Oil to 2-Year High, Wall St. J., 6, 2017, at B10.

- Alison Sider and Stephanie Yang, Oil Market Conquers Its Fears Over Shale, Wall St. J., 15, 2018, https://goo.gl/QYqmYt.

- Howard Silverblatt, Market Attributes: U.S. Equities December 2017, S&P Dow Jones Indices, December 2017 (on file with author).

- Nick Timiraos, Economists Brighten Forecasts for Growth, Wall St. J., 26, 2017, at A2.

- Nick Timiraos, Fed Hikes Rates as Economy Picks Up, Wall St. J., 14, 2017, at A1.

- Chris Williamson, PMI Commentary – Global economy, PMI By IHS Markit, Jan. 4, 2018, https://goo.gl/52UzEF.

- Michael Wursthorn and Riva Gold, Dow Climbs Past 24000 Milepost, Wall St. J., 1, 2017, at B1.

- Michael Wursthorn, Corrie Driebusch, and Georgi Kantchev, Dow Hurtles Past 25000 to Record, Wall St. J., 5, 2018, at A1.

- Stephanie Yang and Alison Sider, Oil Price Buoys Producers’ Hopes, Wall St. J., 29, 2017, at A1.