September was another volatile month that ultimately ended positively. For the month, the S&P 500 gained around 2%, the DOW and S&P500 equal weight (RSP) advanced around 1.8% and value (VTV) gained around .5%. Large Growth/Tech (QQQ) edged a 2% gain, and the rest of the developed world (CWI) advanced by almost 3%. Small caps dipped .5% and bonds (AGG) gained over 1%. Even though most of the broad asset classes gained around the same, the journey to those gains was quite different. The month started with another sell-off during the first week, with QQQ’s again seeing the highest drop of close to 6%, while VTV, RSP and the DOW’s declines were half of that, around 3%.

TWG model portfolios gained over 1%.

For the third quarter, RSP and VTV took the lead, posting more than 8% gains, while the QQQ’s declined close to 2%. S&P 500 gained close to 6% and CWI advanced by more than 5%. Bonds (AGG) gained close to 3% as yields fell.

For the quarter, TWG model portfolios returned between 1.5% and 2%.

WHAT MOVED THE MARKETS

September is statistically the worst month of the year as we move through the seasonally weak period of the calendar. This year seemed to be no different, with the market selling off dramatically during the first full week. There was no real impetus to the sell off, but it seems very similar to the August early month decline.

August inflation data showed ongoing improvement in bringing down inflation closer to the Fed’s 2% target. The CPI print was 2.5%, the lowest level in years. As inflation concerns continue to abate, the primary focus on the market, and admittedly the Fed, is on the full employment side of their dual mandate. This is an important shift in focus, as the Fed feels that inflation will ultimately reach its target, but some upticks in the unemployment rate is becoming an increasingly important driver of market sentiment and investor positioning

As we mentioned in last month’s note, we anticipated heightened volatility as we enter this rate regime shift, and the start of September was no exception. During the first week, the market experienced its worst week of the year, and the second week it experienced its best week of the year. These are big moves, both up and down, as investors reposition ahead of the Fed’s rate policy meeting.

The Fed, during their policy meeting, decided to go big with a .50% rate cut in the Fed funds rate. The market’s reaction was mixed, as stocks initially surged on the report but ended the day in the red after Powell’s press conference. However, the next day markets rallied after having the evening to digest the positives of this large rate cut. Interestingly, the S&P equal weight and the DOW made new all-time highs leading up to the meeting, the S&P 500 index made a new all-time high the day after, but the NASDAQ continued to lag and not yet making a new high. This broadening out of the market is a welcome development with the market’s ability to make new all-time highs without the Magnificent 7 making new all-time highs underscoring the strength of the broader market.

PORTFOLIO POSITIONING and 3Q review

For September, TWG model portfolios saw increases to large blend and reductions in large value. This signifies a much lower risk profile, for example, VTV was less volatile than S&P 500, which was less volatile than QQQ’s. As the market bottomed out early in September and technology began to recover, we added some exposure to QQQ to balance out the value positions.

The third quarter was riddled with volatility and a dramatic shift in trend, as Tech lost its mojo and other market constituents took the lead. Utilities, financials and industrials were the top performing sectors, which are largely value oriented.

Due to entering the quarter with an overweight in large cap growth/Tech, we took a deeper dive to start the quarter. Given the velocity of the tech selloff, we quickly eliminated exposure to QQQ, pivoting to large blend (S&P 500, MOAT, SPGP) and large cap value funds (VTV, SPYV, NOBL) as the trend change emerged. A small stab at small caps, which launched higher as tech declined, was a poor, yet brief trade as that trend reversed as quickly as it emerged. Throughout the quarter, we effected a much greater allocation to large cap value and large cap blend, effectively reducing the volatility of the portfolio as the market attempted to find its footing and new leadership emerged while large cap growth stalled out.

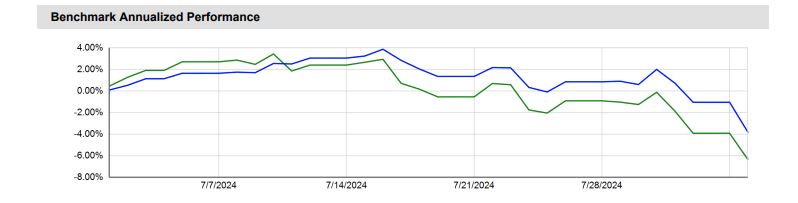

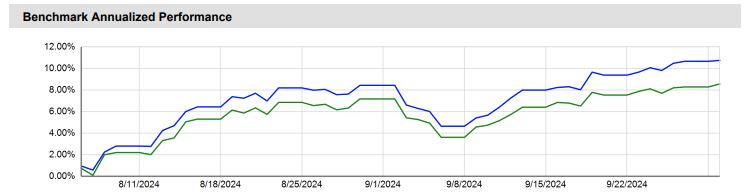

The initial leg down in mid-July bottomed on August 5th, and the market advanced sharply from there through the end of the quarter. Our repositioning during the time set us up to participate in the rebound with a much lower risk profile. For instance (see below graphs), the TWG growth portfolio (green line) declined 6% from July 1 to August 5 vs. a 4% decline for its benchmark (blue line), but then gained 8.5% from August 6th to the end of the quarter, vs. the benchmark advancing 10.5%. Directionally we moved in lockstep, though lagging a little mainly due to foreign stocks gaining more than the U.S. during this period.

TWG Growth portfolio July 1 to August 5.

TWG Growth portfolio August 6 to September 30

We were pleased that we remained fully invested, reduced risk and recovered from a rough start to the quarter to end the quarter at fresh portfolio highs.

LOOKING AHEAD

Historically, the forward direction of the stock market after a Fed rate cut has been dependent on the economic backdrop that precedes the rate shift. Over the past three rate cut cycles (COVID-19, the Great Financial crisis of 2007 and the dot com bubble in 2000), where the Fed was forced to cut rates to save a souring economy, six-month forward returns were generally negative. In past instances like today, where the Fed cut rates in a relatively strong economic environment, future returns were generally positive.

Over the past weeks, the market has been confronted by several potentially rattling events – an outbreak in the Middle East, extensive damage from hurricane Helene, a major strike in the Gulf and East Coast ports, – the fact that the market is still within 1% of its all-time high suggests the economy continues to show strength and resilience. This, coupled with the start of a rate-cutting cycle, appears that the market can continue to move higher.

However, in our opinion, the market is priced to perfection, as it is relatively “expensive” and valuation are stretched. As the earnings season begins next week, once again corporate America will have to justify their extended valuations through continued growth in their earnings. Earnings are expected to decelerate for Technology companies but accelerate in almost every other sector. This potentially sets a nice backdrop for the newly emerging leaders to continue their leadership.

In summary, earnings are still growing for many areas of the economy, the Fed is moving to a less restrictive policy stance, unemployment remains historically low and GDP remains strong. These factors tend to be productive for risk assets.

The quarter ahead will likely be volatile, particularly heading into the election. The job market will likely be the focus of the markets and the Fed to further confirm whether we are still on a path to a soft landing, where inflation is in check, employment robust, and a recession can be avoided. We are in the camp that a soft landing is the most likely scenario.

At least we can move on from constantly talking about inflation as it has been several years since other events had as great of an impact on positioning and sentiment!

Enjoy the crisp air that comes with the change of season. We will continue to manage risk and seek returns as we enter a new era of lower rates and a broadening market.