Spring has arrived, at least according to the calendar! We hope this note finds you well and emerging from the grips of the colder weather. Although still punctuated by a back-and-forth battleground (growth vs value, small vs large) March was the most productive month this year, with the S&P increasing 4.24%. The bond market, however, continued to retreat, declining 1.25%. Seventy-five percent of the S&P’s 5.75% YTD gains, and 37% of the bond market’s 3.35% YTD loss occurred in March.

Looking back over the past three months, the market leadership looks dramatically different than 2020. Last year’s leaders are this year’s laggards, with the DOW up over 8% YTD and the NASDAQ up only 1%. Though both the small cap Russell 2000 and the NASDAQ are still around 8% off their 2021 all-time highs, the Dow and the S&P close the quarter at new all-time highs.

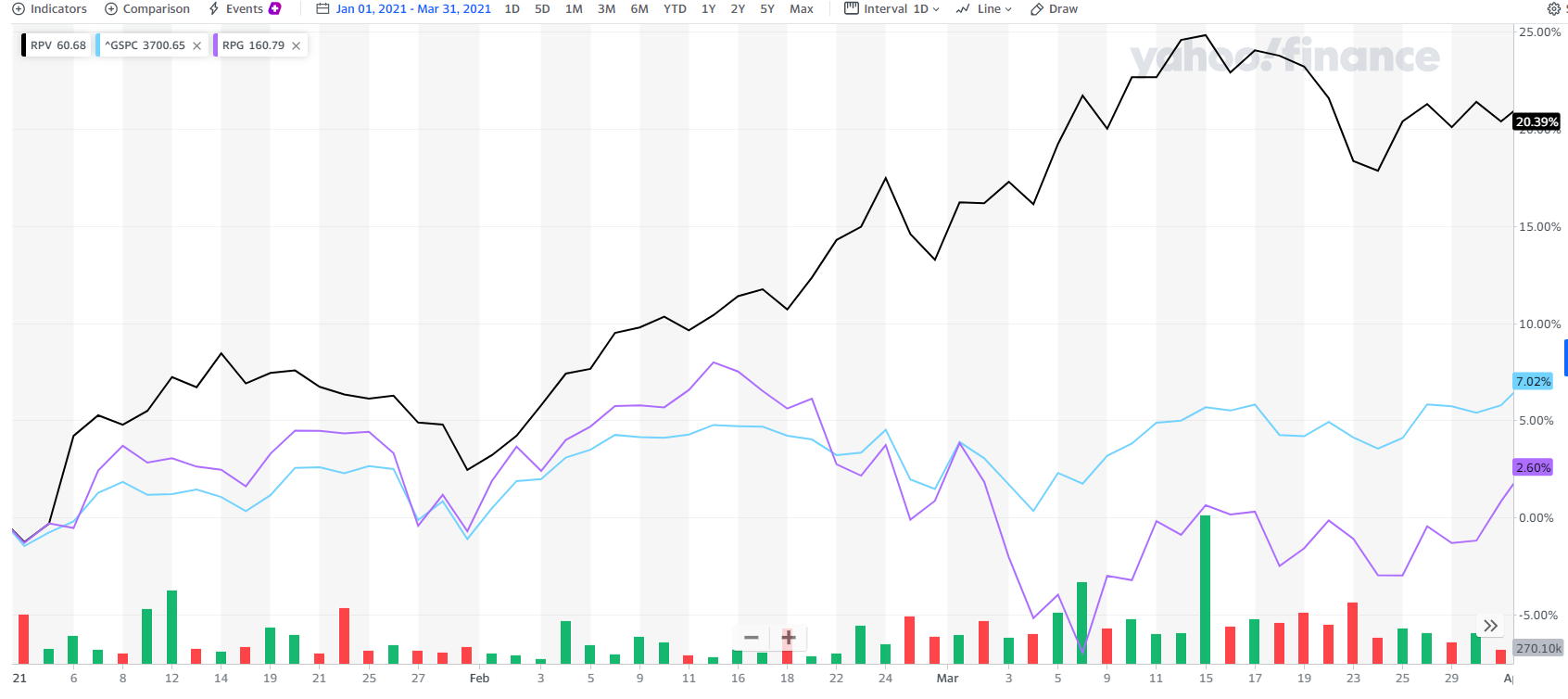

Zooming in at size charts (large, mid, small) and style (growth, blend, value), the dispersion becomes clearer. RPV, our large cap value proxy, closed the quarter up over 20%, while RPG, our large cap growth proxy was up only 2.5%.

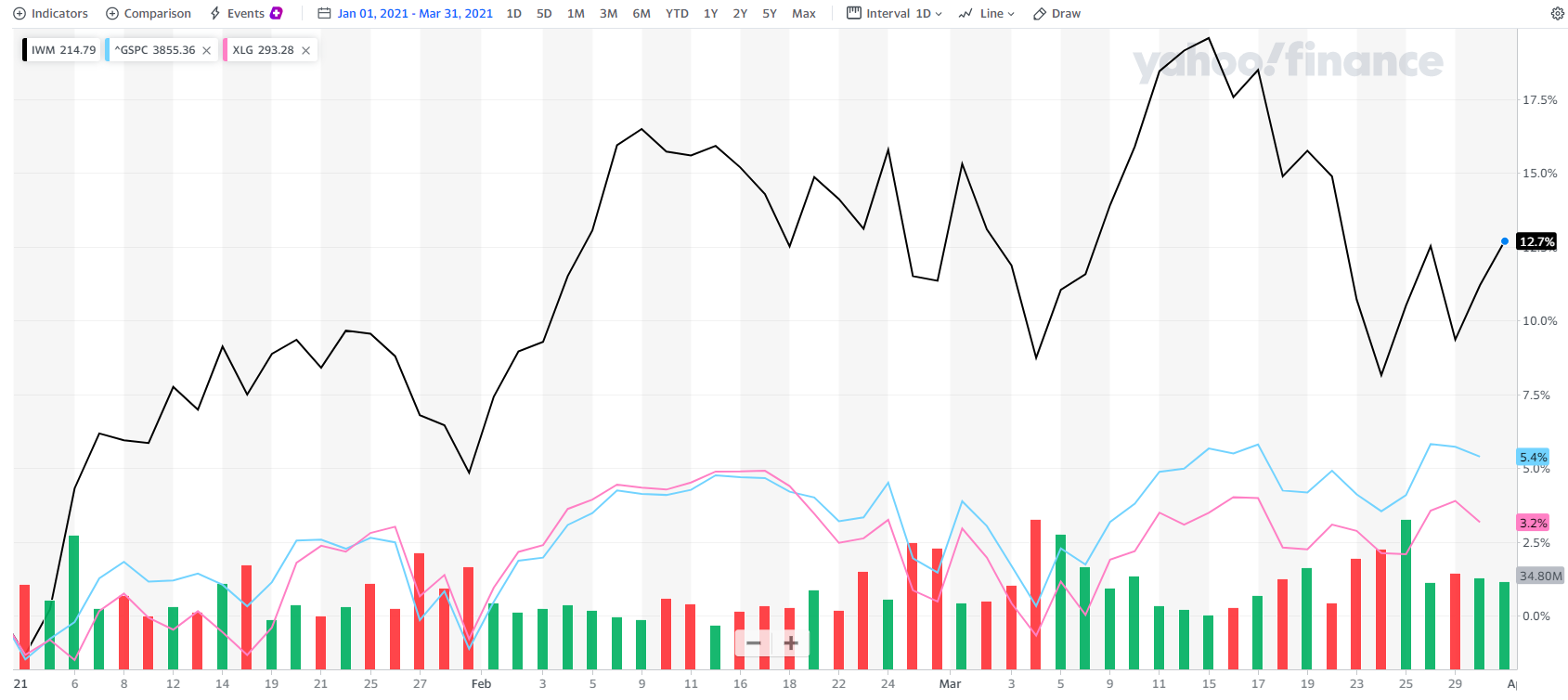

IWM, our small cap proxy, closed the quarter up 12.7% while XLG (S&P top 50), our large cap proxy, was up only 3.2%

Risk models were up nicely as well. For the current year, conservative is up 2.75%, outperforming its benchmark, net of fees. Moderate is up 3.5%, matching its benchmark before fees. The growth model, inherently having greater exposure to more growth style investments, is up 4.6% — just slightly underperforming its benchmark before fees. All in all, given the markets seemingly daily rotation between cyclicals/value, tech/growth, and large/small we are pleased with these results. On a one-year basis, results were rather robust, with conservative up 25%, moderate up 33%, and growth up 40% net of fees.

We want to note, that while the one-year returns are significant, it was not achieved without challenges stemming from an environment fraught with fear, risk and uncertainty. During last year’s cycle low, when the S&P was down 34% from its pre-pandemic high, we did not (nor will we during subsequent bear markets) have the luxury of seeing the right side of the chart. Hindsight is 2020, and through our objective risk management process, we were not only able to shield and protect your accounts during the depth of the recession, but we were also able to obtain our fair share of the market rebound.

Furthermore, it is equally important to take a long-term view of returns, not only when the one-year results are up so dramatically, but also when they are down. While the one-year trailing returns will unlikely be replicated in the year ahead, over time we remain confident that our dynamic allocation process will generate competitive risk-adjusted returns. This will enable your money to grow at the risk appropriate, anticipated rate of return allowing your financial plan to achieve its modeled probability of success. This success will allow you and your family to achieve your stated goals and objectives, provide peace of mind and future financial security.

PORTFOLIO ADJUSTMENTS – MARCH

As interest rates and bond yields continued to move higher, effecting significant selling pressure on higher valuation and growth stocks, we cut our losses and evacuated our small position in ARKK initially purchased in January. The previous gains evaporated in a swift drawdown. We rotated those proceeds at the beginning of March to XLF, a financial sector ETF, as well as RPV, a pure large cap value ETF. As the growth selling continued, we captured a gain from FNY, a mid-cap growth EFT and repositioned the proceeds to FAB, a multi-cap value ETF. At the end of the month, as the market swings to growth and value daily, we shifted the recently purchased RPV position to SPY, an S&P 500 ETF. These adjustments, while being more overweight value at the beginning of the month, currently position us to be more balanced, still with a value bias but less so than where we stood throughout the month.

Standout positions for the year include VLUE, our large cap value fund purchased on 12/3/20, up 18% YTD, and RSP, the equal weight S&P500 fund purchased on 2/19/21, up 13% YTD. Allocating capital to areas of relative strength help offset some less than productive core growth areas of your portfolio, such as QQQ – NASDAQ 100 ETF. It is imperative that we maintain some exposure to growth through all times, and we believe that growth is still an important style to own notwithstanding the current years’ challenges in that space.

LOOKING AHEAD

With the market taking a breath in January and February, but performing very well in March, we remain cautiously optimistic about the quarter ahead. As more and more people get vaccinated; the warmer weather providing a seasonal backdrop to getting out and about; and the new stimulus bill putting more cash into the hands of Americans, we anticipate demand to pick up, perhaps even close to pre-pandemic levels.

This should bode well for spending and sales, improving corporate earnings and profit, reducing the unemployment rate, and move U.S. GDP perhaps to pre-pandemic levels, signalizing a true V-shape recovery. To the extent that this expected demand pick-up is already priced into the market is anyone’s guess. However, we remain committed to our process of identifying sustainable areas in the market that are exhibiting greater productivity than the broad market and will continue to allocate a capital accordingly.

Our belief is that the S&P will see returns more in line with historical averages this year, up between 6-8%. With the S&P already up close to 6% this year, a period of consolidation, perhaps through the summer months, is not unreasonable. This may yield more moderate, 1-3% returns for the upcoming quarter, though a sleepy summer fade/slow decline is also not off the table. Only time will tell but know that we will be monitoring the financial markets daily and make the necessary adjustments to your portfolio to increase the likelihood that our return bogey’s will be met, or retained, during the course of the year.

We wish you well.