December had a strong follow-through from an equally strong November. The S&P 500 advanced 4.42% and the DOW gained 4.84%. Mid-caps and small-caps played catch up after significantly lagging their large-cap brethren with gains of 8.5% and 12.6% respectively. The year ended on a nine-week run of gains, something that rarely occurs, as market breath continued to expand.

QQQ was up 5%, RSP (S&P500 equal weight) advanced 6.4%, and bonds gained 2.6% as yields continued to decline. The rest of the developed world (CWI) lagged the US with a gain of 2.3%

TWG models increased for the month, with conservative, moderate and growth advancing 3.75%, 4.14% and 4.82% relative to their benchmarks 4.68%, 4.9% and 5.11%.

For the fourth quarter, the S&P 500 was up over 10%, RSP up 11%, QQQ up 14%, CWI 7.4% and bonds up 5%.

WHAT DROVE THE MARKET

A continued deluge of favorable economic data continued to improve market sentiment, creating a “buy everything” rally to end the year. The big drivers continued to be declining interest rates and inflation, which supports the narrative of a possible soft landing, where economic activity weakens enough to cool inflation but not so much as to cause a deep recession.

On 12/5 the JOLTS (job openings) data showed continued softness in the labor market, adding to the trend that the strength in job availability is abating. A weaker labor market is what the Fed has felt is needed to temper inflation. One is less likely to quit if replacement jobs are few. This also helps reduce wage growth, which is inherently inflationary. Stocks reversed the early month malaise on the news.

Two days later we saw a big surge in the market on the heels of continuing jobless claims data. Said data reflected a slight increase in claims. Though layoffs remain extremely low, there is a trend being established that points to a slightly weaker job market, which has been one pillar of the economy that has been causing elevated prices. The unemployment rate ticked up .3%, further signaling a slowdown in the economy.

In the middle of the month, CPI (consumer price index) data came in neither too hot nor too cool, but widely as expected. Inflation rose .1% in November for a year-over-year rate of 3.1%. Core inflation (excluded food and energy) climbed .3% on the month and 4% year over year. Core inflation appears to be stuck in the low 4% range after receding meaningfully through August. Housing inflation remails elevated and used car pricing spiked higher in November. The stickiness of core is something to be mindful of as the Fed fights for the last push back down to 2%, a level that appears will take more time than perhaps the market is pricing in. In our opinion, market expectations of a rate cut in the first half of 2024 are premature.

On 12/13 the Federal reserve held rates steady, as expected. Stocks rallied over 1.5% as Powell introduced policy language indicating rate cuts are likely in 2024. This “pivot” was the first time that Powell entertained speaking about easing. However, it is important that the Fed reduces rates for the right reasons. Their logic is that since inflation has declined meaningfully from its peak, the current 5.25% to 5.5% level is now too restrictive, if inflation continues to decline. They feel that they can ease without a rate cut being too accommodative, and we think this logic makes sense. However, if they must ease more than the three rate cuts that the market was pricing in at that time, it could be for the wrong reason – namely because the probability of a recession has increased. It is still too early to call either scenario, but we welcome the news of their seemingly readiness to cut rates in 2024.

A YEAR IN REVIEW

The start of the year caught a lot of investors flat footed, us included. As mentioned in earlier notes, 2022’s losers quickly became 2023 winners. From the first day of 2023, the largest tech companies in the U.S. (and the world) reversed their downtrend from 2022 and rocketed higher out of the gate. Since the S&P 500 is primarily driven by these mega cap names, as they carry so much weight, almost everything else lagged to start the year, even 2022’s winners (energy, value). If you did not own either the market cap weighted S&P 500, or the QQQ (or their top holdings – Apple, Microsoft, Nvidia, Amazon, Google, Meta), advances for the first quarter were elusive.

March 2023 ushered in a banking crisis with the collapse of SVB and a few other banks, causing stress in most corners of the market that require traditional lending facilities to continue to operate. Notably small companies and energy, that are extremely reliant on bank lending, and anything tied to the financial sector declined significantly. This is where we were predominately positioned during January and February, with most of our equity exposure in S&P equal weight (carried over from 2022 which lost much less in value that the S&P cap weight), as well as value funds which are more exposed to financials, energy and more economically sensitive areas of the economy. Only those largest names, who are so cash rich that they don’t really need traditional financing channels, did not get caught up in an otherwise broad downdraft.

However, upon implementing our updated strategy, which we have discussed over the course of the year, TWG model portfolios once again moved in the same direction as the broad market, enabling your accounts to erase the declines incurred during the first quarter, and carried us to strong gains to close the year. Inherent to a trend following process, when trends abruptly change there is a lag effect for the process to identify and then catch up to those new trends. Our updated strategy has demonstrated, over a period of nine months now, its ability to adjust more quickly to changing trends, and doing so on a more consistent basis.

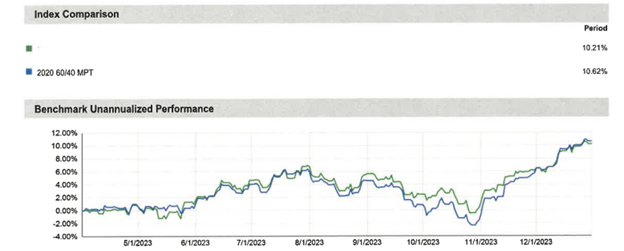

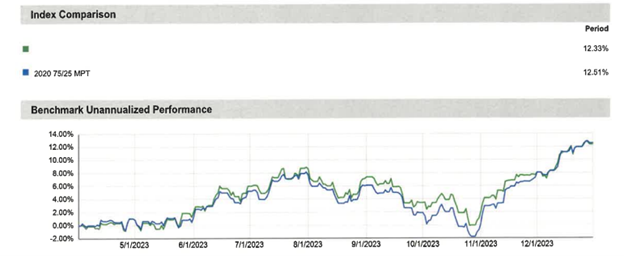

Below are infographics of the TWG conservative, moderate and growth portfolios from April through December, clearly demonstrating the positive advancements of our current strategy. This time period, we may add, was not straight up and to the right, but rather rattled with twists and turns and some bumps along the way. We navigated this environment with much greater consistency than in prior years, given the additional models and funds our process evaluates. Trades were many, but smaller, which helps us sniff out emerging trends that may or may not continue. But when they do, we have observed a continued selling out of weakness and buying into the strength of the emerging trends.

TWG Conservative 60/40 – 10.21% net of fees vs 10.62% Benchmark

TWG Moderate 75/25 – 12.33% net of fees vs 12.51% Benchmark

TWG Growth 90/10 – 13.98% net of fees vs 14.41% Benchmark

Case in point, QQQ became our largest position from around May through the end of the year, vacillating between 30% to 70% of our equity exposure. From April through December, QQQ’s advanced twice the rate as the S&P 500, and we were very much invested in QQQ’s during that period.

We are pleased at the performance from the April to the year-end period. An observation of the graphs below is that TWG model portfolios were more tightly correlated to a rising market environment than ever before, and during the period of decline from August to late October, having raised around 10% cash reduced the risk and drawdown relative to the model’s benchmark.

LOOKING FORWARD

After the year-end rally, stocks are somewhat in overbought levels, and we could imagine a period of consolidation before a potential leg higher. Earnings season will be critical this quarter. Granted, earnings improved during the Q3 reporting season, after troughing in Q2. However, as share prices ran up into year-end based on the market pricing in six Fed cuts in 2024, starting in March, the market is vulnerable to strong economic data which may force the Fed to stay higher for longer. Earnings growth that matches or exceeds expectations will likely be required for stocks to justify their lofty valuations. It’s probably going to be a show up or shut up environment, where earnings expansion/growth will be necessary to justify the high earnings multiples that accompany many stocks. Conversely, if earnings come in lower than expectations, then their current lofty multiples will likely be harder for investors to justify owning shares.

If earnings fall below estimates, then the market may very well show an unwillingness to hold expensive stocks, particularly if forward earnings guidance is cautious. Only time will tell, but we’ll be keeping a close eye on corporate earnings to determine the tone of market sentiment.

In addition, upcoming inflation data must continue the downward trend for the Fed pivot narrative to manifest and act as a tailwind for stocks. The line between good news is good news and good news is bad news is as thin as ever, and a blip higher one month is rarely enough to determine a trend change. But the inflationary path from 3% to 2% will likely be bumpy. So long as the longer-term trend continues to decline, we anticipate the Fed will have the ability to reduce rates to some extent this year. In our opinion, six rate cuts is probably more than the Fed will likely cut, but any relief in the Fed funds rate should help stocks maintain current levels.

2024 will be an interesting, and likely challenging year for risk assets. There are a myriad of factors that will drive earnings, sentiment, and returns. While Fed rate policy and inflation will still likely be major drivers of the market, geopolitical tensions, war, the Middle East Israel/Palestine conflict, China/Tawain, and the upcoming presidential election will undoubtedly affect the prices of stocks.

Regardless of what occurs and where the market heads, we are well equipped to manage your investment portfolios in just about any environment that comes our way. If the market continues its advance, then we are well positioned to ride the wave higher. However, should the market move through a period of stress and uncertainty, our process will guide us to less risky corners of the market and even increase our cash allocation until the market finds its footing. Remember, money must flow somewhere, and our portfolios have plenty of places in which to sniff out where capital is flowing to, and from, which we will adjust accordingly.

Stay warm, and remember the days are already getting longer.